| Notice of Annual Meeting of Shareholders |

Letter to Cardinal Health Shareholders

Gregory B. Kenny

Chairman of the Board

September 20, 2019

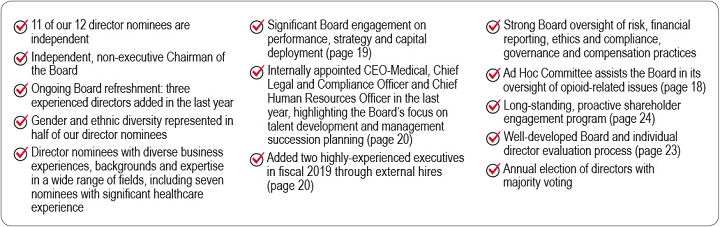

TheBoardofDirectorstakesseriouslyitsoversightroleandresponsibilityforgoodcorporategovernanceaswestrivetocreatevalueforourshareholders.Overthepastyear,wehavemadeimportantprogressinanumberofareas,andIwanttosharetheBoard’sperspectiveonsomeofthechangesnowunderwayasCardinalHealthcontinuestopositionitselfforthefuture.

SuccessfulBoardLeadershipTransition

Effective at last year’s Annual Meeting of Shareholders, I assumed the role of non-executive Chairman of the Board, after having served as Lead Director for the prior four years. In my first year as Chairman, I worked closely with the Board and our leadership team to assure that our governance practices continue to be aligned with the best interests of our company and shareholders. To that end, I devoted significant time and thought to utilizing the many talents and experience of the Board as we engaged with senior management on a variety of critical issues, including strategic priorities, capital deployment, operational efficiencies, the opioid epidemic and risk mitigation — all with the goal of enhancing shareholder value.

ComprehensiveReviewoftheBusiness

During fiscal 2019, the Board and management worked closely to complete a comprehensive review of the company’s portfolio, cost structure and capital deployment, which is explained in the proxy statement. The Board was actively engaged in this process, participating in extensive discussions, and continues to receive regular, detailed updates on progress.

OngoingBoardRefreshmentandCommitteeChanges

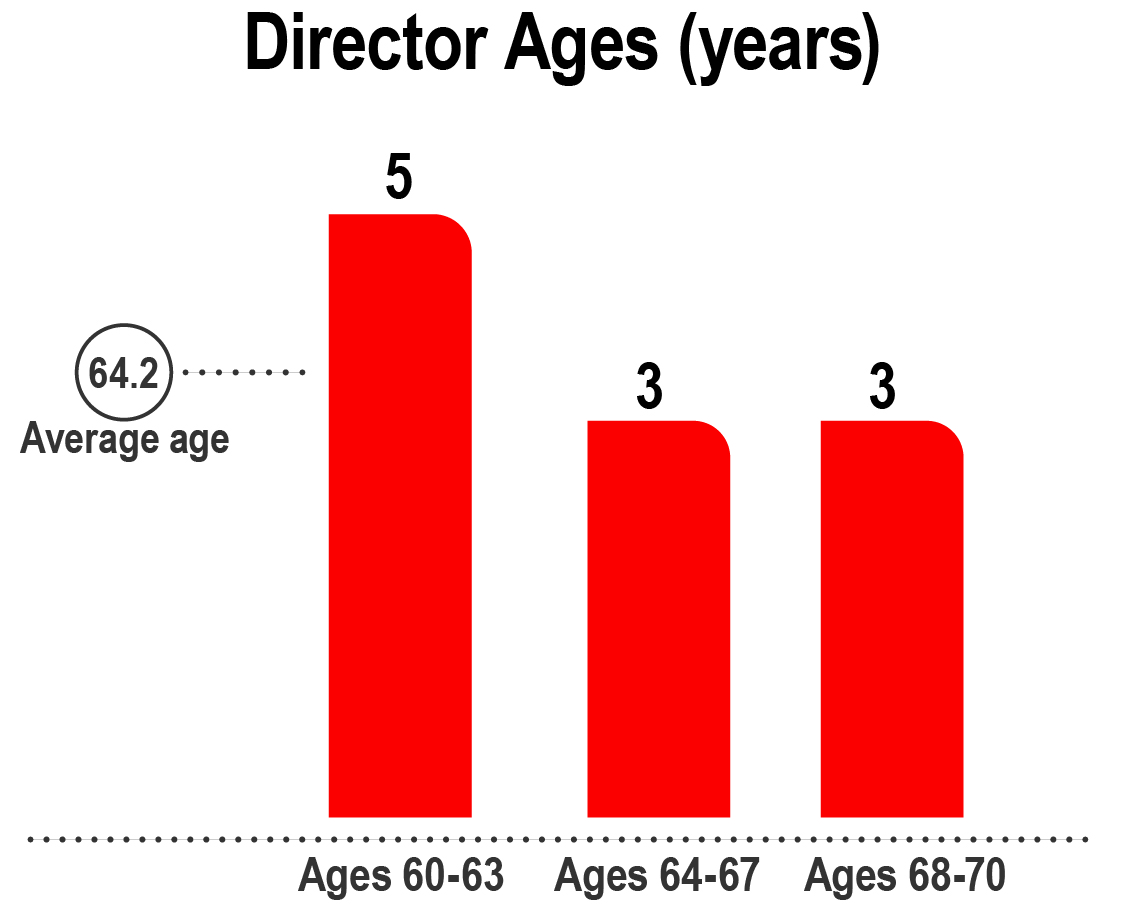

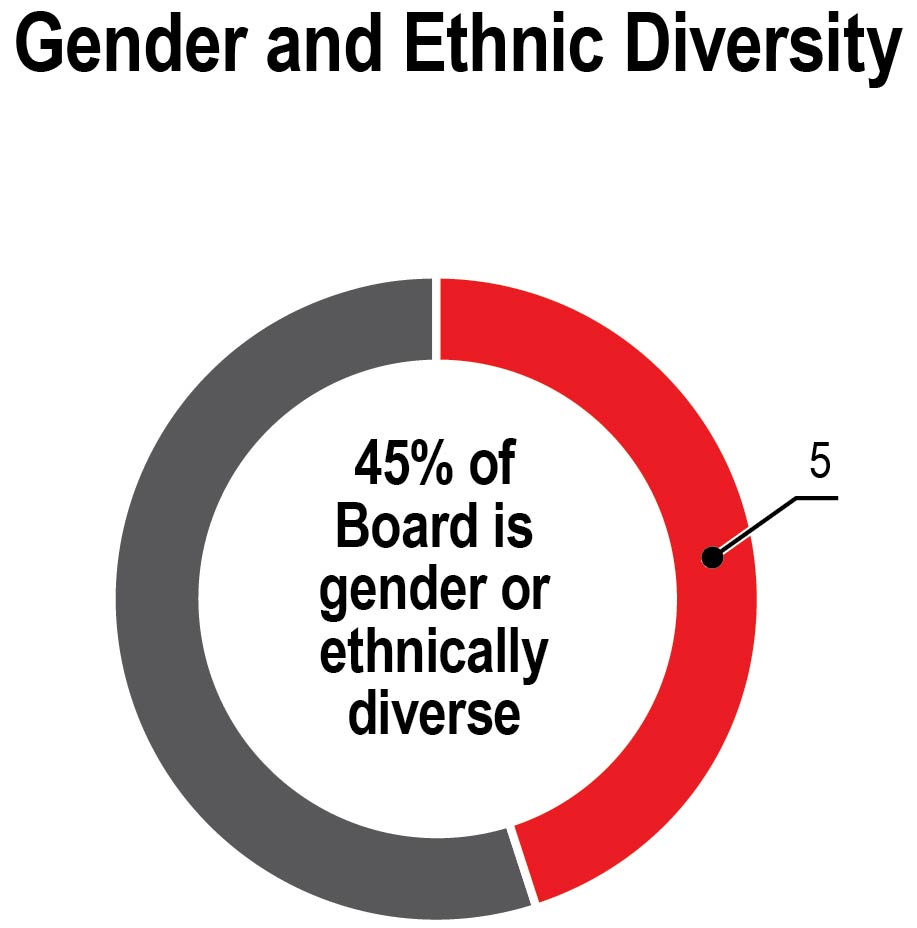

We are committed to having in place a Board of Directors with a combination of diverse skills, backgrounds and experience to support the company’s evolving business and strategic direction and to fulfill our oversight responsibilities. To that end, we have continued to refresh our Board membership and are pleased to have added three new directors over the past year.

Last December, we welcomed back former Cardinal Health director Mike Losh to a new term as a director. Mike, who previously served as Chief Financial Officer of General Motors, brings deep financial experience, as well as valuable insights due to his experience with our company. With his extensive financial and leadership background, he was able to immediately assume the important responsibility of chairing our Audit Committee. We are fortunate to benefit from his decades of experience and extensive public company board leadership expertise.

As of September 1st, we have added two more independent directors: Dean Scarborough and John Weiland. Dean was Chairman and Chief Executive Officer of Avery Dennison and brings to the Board experience in manufacturing and distribution, as well as a global perspective. John was President and Chief Operating Officer of medical device maker C. R. Bard and brings over 40 years of healthcare industry experience to the Board. We are very pleased to welcome these two talented former executives who bring a wealth of business and industry experience, as well as experience serving on other public company boards. These appointments bring the total number of Cardinal Health directors to 12, 11 of whom are independent.

The Board also made important new appointments to committee leadership. Carrie Cox succeeded Dave King as Chair of the Human Resources and Compensation Committee and Pat Hemingway Hall succeeded me as Chair of the Nominating and Governance Committee.

BoardOversightandtheOpioidEpidemic

The Board and the company care deeply about the opioid epidemic and take seriously our commitment, in cooperation with other participants in the pharmaceutical supply chain, to find and support solutions to this national challenge. As a distributor and an intermediary in the supply chain, Cardinal Health has an important but limited and specific role — which is, to provide a secure channel to deliver medications from manufacturers to our thousands of hospital and pharmacy customers licensed to dispense them to patients, and to work diligently to identify, stop and report to regulators suspicious orders of controlled substances.

The Board has been and remains active in overseeing Cardinal Health’s response to the opioid epidemic. The Board’s Ad Hoc Committee of independent directors assists the Board in its oversight of opioid-related issues, continues to meet regularly and reports at every Board meeting. As the opioid litigation moves closer to the first scheduled trial date in October, the Ad Hoc Committee will continue to be actively engaged, overseeing our efforts to vigorously defend ourselves and the discussions about possible litigation resolutions. In addition, we continue to monitor the business and reputational impacts stemming from the epidemic and the surrounding litigation.

ThankYou

I believe that we have a strong, engaged Board of Directors and on behalf of our Board, I thank you for your share ownership in Cardinal Health and your continued support of the company. I look forward to continuing our ongoing and active dialogue.

Sincerely,

GregoryB.Kenny

ChairmanoftheBoard

Cardinal Health |2019 Proxy Statement1

Notice of Annual Meeting of Shareholders

Wednesday, November 6, 2019

8:00a.m.EasternTime

CardinalHealth,Inc.

7000 Cardinal Place

Dublin, Ohio 43017

Important notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on November 6, 2019:

This Notice of Annual Meeting of Shareholders, the accompanying proxy statement and our fiscal 2019 Annual Report to Shareholders are available at www.edocumentview/cah. These proxy materials are first being sent or made available to shareholders commencing on September 20, 2019.

To vote on the following proposals:

To elect the 12 director nominees named in the proxy statement;

To ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, 2020;

To approve, on a non-binding advisory basis, the compensation of our named executive officers; and

To transact such other business as may properly come before the meeting or any adjournment or postponement.

Shareholders of record at the close of business on September 9, 2019 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement.

By Order of the Board of Directors.

September 20, 2019

JohnM.Adams,Jr.

SeniorVicePresident,

AssociateGeneralCounsel

andSecretary

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 2 |

This summary highlights information contained elsewhere in our proxy statement. This summary does not contain all the information that you should consider, and you should carefully read the entire proxy statement and our fiscal 2019 Annual Report to Shareholders before voting. References to our fiscal years in the proxy statement mean the fiscal year ended or ending on June 30 of such year. For example, “fiscal 2019” refers to the fiscal year ended June 30, 2019.

Headquartered in Dublin, Ohio, we are a global integrated healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories and physician offices. We provide medical products and pharmaceuticals and cost-effective solutions that enhance supply chain efficiency from hospital to home.

Fiscal 2019 was a year of progress for Cardinal Health. We delivered on our overall goals and made significant strides on key strategic initiatives.

Fiscal 2019 performance highlights include:

Revenue was $145.5 billion.

GAAP operating earnings were $2.1 billion and non-GAAP operating earnings were $2.4 billion.

GAAP diluted earnings per share (“EPS”) were $4.53 and non-GAAP EPS were $5.28.

Operating cash flow was $2.7 billion.

Returned $1.2 billion to shareholders, including $600 million in share repurchases and $577 million in dividends.

Repaid $1.1 billion of long-term debt.

Pharmaceutical segment revenue was $129.9 billion and segment profit was $1.8 billion.

Medical segment revenue was $15.6 billion and segment profit was $576 million.

Realized annual savings of over $130 million in fiscal 2019 through cost optimization initiatives.

Other highlights for the fiscal year include:

Renewed our contracts with CVS Health and Kroger for at least the next four years.

Finalized a partnership with Clayton, Dubilier & Rice to jointly invest in naviHealth and accelerate its growth.

See Annex A for reconciliations to the comparable financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the reasons why we use non-GAAP financial measures.

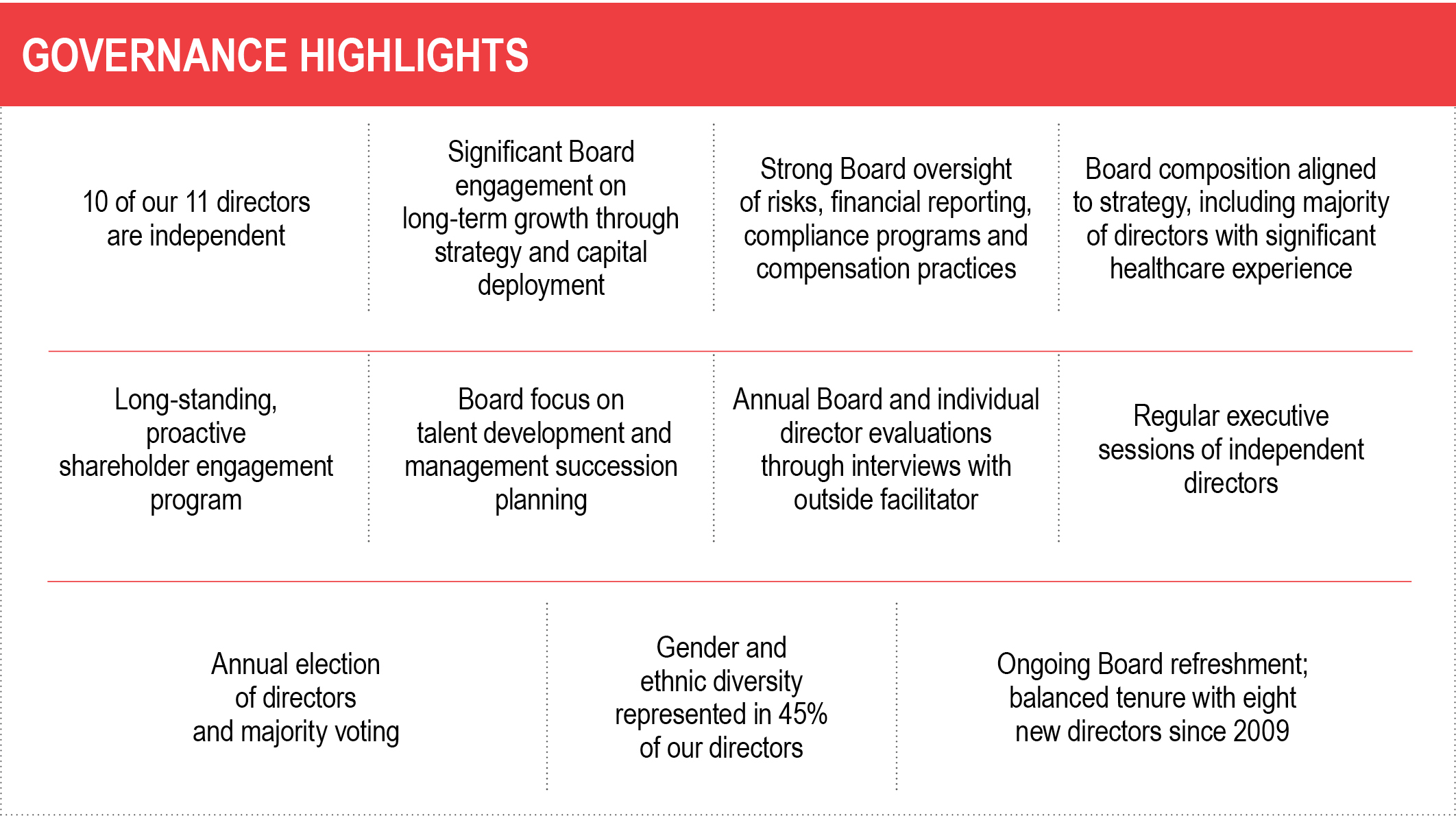

Governance and Board Highlights

Cardinal Health |2019 Proxy Statement3

|  |  |  |

| Calvin Darden | Bruce L. Downey | ||

and Distribution, IBM Age: 62 Director since2007 Independent Committees: A | Global Pharmaceuticals, Schering-Plough and retired Chairman and CEO, Humacyte, Inc. Age: 62 Director since2009 Independent Committees: H, AH | Retired SVP of U.S. Operations, UPS Age: 69 Director since2005 Independent Committees: H, AH | Retired Chairman and CEO, Barr Pharmaceuticals and Partner, NewSpring Health Capital II, L.P. Age: 71 Director since2009 Independent Committees: N, AH |

|  |  |  |

| Patricia A. Hemingway Hall | Akhil Johri | Michael C. Kaufmann | Gregory B. Kenny |

| Retired President and CEO, Health Care Service Corp. Age: 66 Director since2013 Independent Committees: H, N | EVP and CFO, United Technologies Age: 58 Director since2018 Independent Committees: A | CEO, Cardinal Health Age: 56 Director since2018 | Retired President and CEO, General Cable Age: 66 Director since2007 Independent Chairman of the Board Committees: N, AH |

|  |  |  |

| Nancy Killefer | J. Michael Losh | Dean A. Scarborough | John H. Weiland |

| Retired Senior Partner, Public Sector Practice, McKinsey Age: 65 Director since2015 Independent Committees: H | Retired EVP and CFO, General Motors Age: 73 Director since2018 Independent Committees: A | Retired Chairman and CEO, Avery Dennison Age: 63 Director since2019 Independent Committees: A | Retired President and Chief Operating Officer, C. R. Bard Age: 63 Director since2019 Independent Committees: A |

A: Audit AH: Ad Hoc N: Nominating and Governance H: Human Resources and Compensation

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 4 |

Addressing the Opioid Epidemic

We care deeply about the opioid epidemic and take seriously our commitment, in cooperation with other participants in the prescription drug supply chain, to find and support solutions to this national challenge.

As a distributor and an intermediary in the supply chain, we play an important, but limited and specific role: we provide a secure channel to deliver all kinds of medications from the hundreds of manufacturers that make them to our thousands of hospital and pharmacy customers licensed to dispense them to their patients, and we work diligently to identify, stop and report to regulators suspicious orders of controlled substances.

The Board has been and remains active in overseeing our response to the opioid epidemic. The Board’s Ad Hoc Committee comprised of independent directors Cox, Darden, Downey and Kenny assists the Board in its oversight of opioid-related issues. The Ad Hoc Committee continues to meet twice per quarter and engage with the other directors on opioid-related issues at every Board meeting.

As the first scheduled trial date (October 2019) in the opioid litigation approaches, the Ad Hoc Committee is receiving regular updates on the current status of the litigation and discussions of possible litigation resolutions and is monitoring the business and reputational impacts. The Ad Hoc Committee also has received updates on our anti-diversion program, legislative and regulatory developments, shareholder engagement and developments in our Opioid Action Program.

We use a multi-factor process to evaluate pharmacies before they become customers, including taking steps to understand their business and historical prescription drug ordering patterns. Controlled substance orders pass through our order monitoring system, which tracks orders against statistical benchmarks for signs of potential diversion. If an order is deemed suspicious, it is canceled and reported to the U.S. Drug Enforcement Administration (“DEA”) and applicable state regulators. We also have a team of experienced investigators who regularly conduct customer site visits, both announced and unannounced. Finally, we have a committee of senior anti-diversion and regulatory experts that meets regularly to evaluate customers with higher-volume controlled substance orders.

Our anti-diversion program includes constantly adaptive, rigorous systems. Recent updates include access to the DEA database known as “ARCOS” that collects data around the flow of controlled substances through the supply chain and system and process enhancements to comply with a recently enacted Ohio rule.

Opioid Action Program and Generation Rx

As part of our Opioid Action Program launched in 2017, the Cardinal Health Foundation recently awarded nearly $1 million in additional grants to state pharmacy associations and colleges of pharmacy to support best strategies for prescribing practices. Other activities during fiscal 2019 included hosting the recipients of our 2018 “Best Practices in Opioid Prescribing” grants, pain management experts and other healthcare providers at a two-day symposium in Central Ohio, to discuss best practices, successes and challenges in managing pain with fewer prescribed opioids. Also, during the fiscal year, we partnered with Kroger on drug take-back events at more than 200 local pharmacy locations across the country.

Cardinal Health also has been a leader in pioneering and supporting impactful prevention and education programs to combat opioid abuse under the umbrella of Generation Rx, a national program developed by the Cardinal Health Foundation and The Ohio State University College of Pharmacy. This year marks the 10th anniversary of Generation Rx, which has more than 100 pharmacy school chapters.

Cardinal Health |2019 Proxy Statement5

Attending the Annual Meeting of Shareholders

See page 52 for instructions on how to gain admission to Cardinal Health’s 2019 Annual Meeting of Shareholders (the “Annual Meeting”).

Shareholders will be asked to vote on the following proposals at the Annual Meeting:

Proposal | Board Recommendation | Page Reference | ||

Proposal1: to elect the | FOR each director nominee | 7 | ||

Proposal2: to ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, | FOR | 27 | ||

Proposal3: to approve, on a non-binding advisory basis, the compensation of our named executive | FOR | 29 |

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 6 |

Election of Directors

The Board has nominated 12 directors for election at the Annual Meeting to serve until the next Annual Meeting of Shareholders and until their successor is duly elected and qualified. Each director nominee agreed to be named in this proxy statement and to serve if elected. If, due to death or other unexpected occurrence, one or more of the director nominees is not available for election, proxies will be voted for the election of any substitute nominee the Board selects.

| The Board recommends that you vote FOR the election of the nominees listed on pages 8 to 13. |

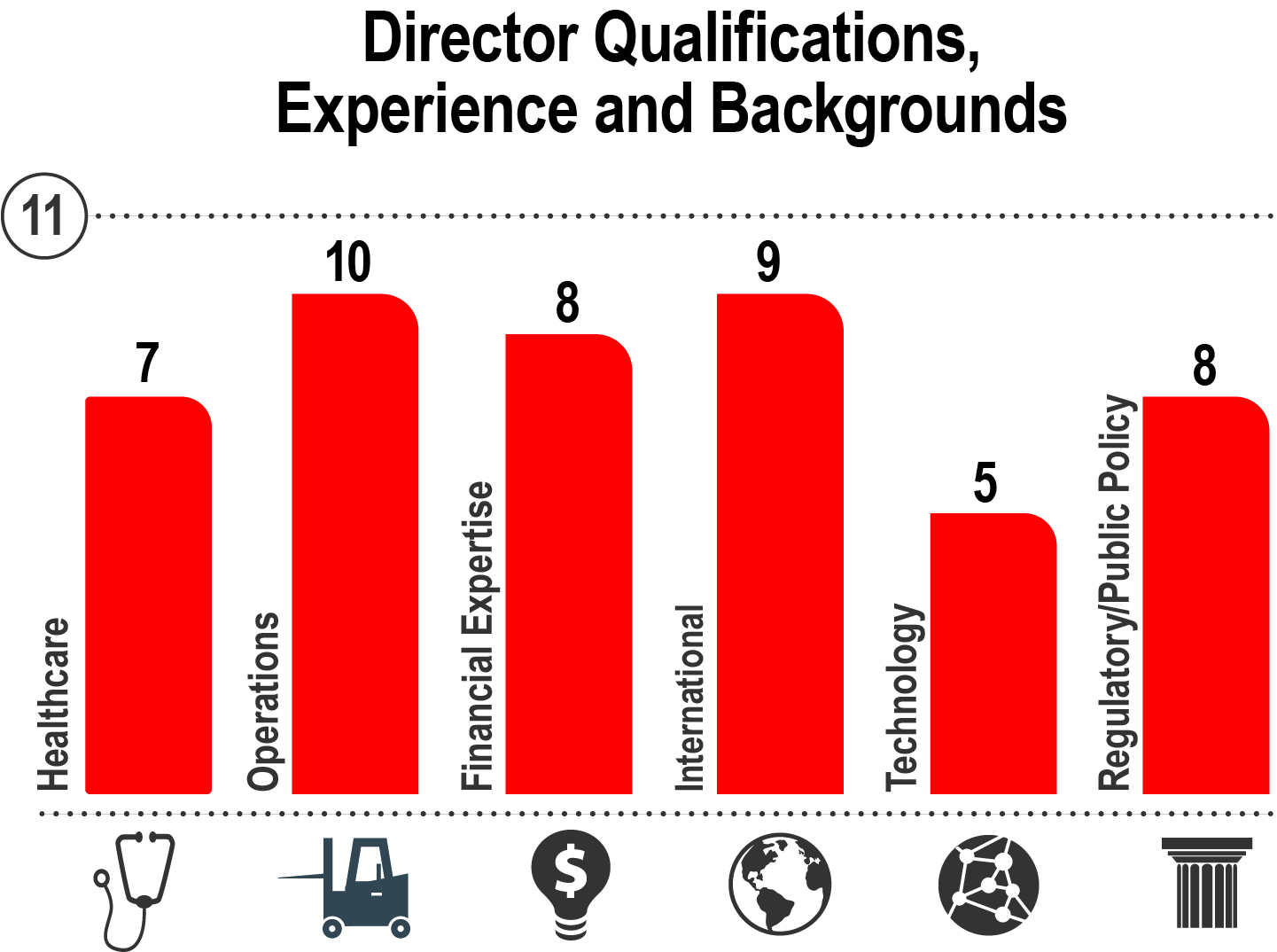

Board Membership Criteria: What we look for

The Nominating and Governance Committee considers and reviews with the Board the appropriate skills and characteristics for Board members in the context of the Board’s current composition and objectives. Criteria for identifying and evaluating candidates for the Board include:

business experience, qualifications, attributes and skills, such as relevant industry knowledge (including pharmaceutical, medical device and other healthcare industry knowledge), accounting and finance, operations, technology and international markets;

leadership experience as a chief executive officer, senior executive or leader of a significant business operation or function;

financial and accounting experience as a chief financial officer;

independence (including independence from the interests of any single group of shareholders);

judgment and integrity;

ability to commit sufficient time and attention to the activities of the Board;

diversity of age, gender and ethnicity; and

absence of potential conflicts with our interests.

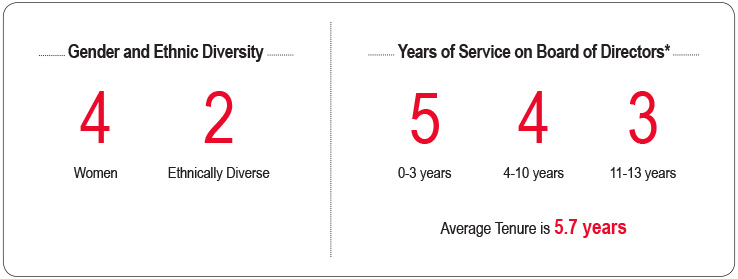

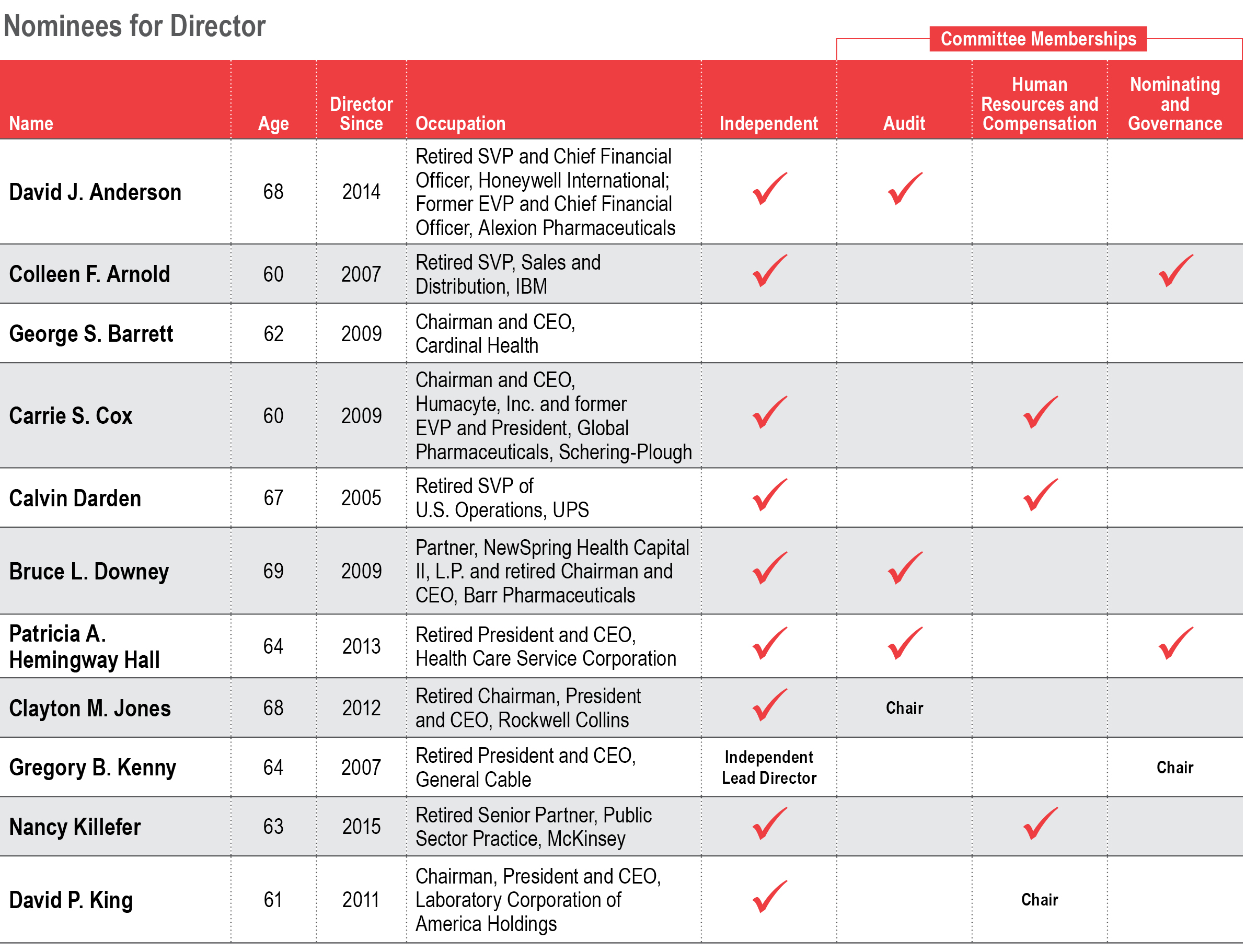

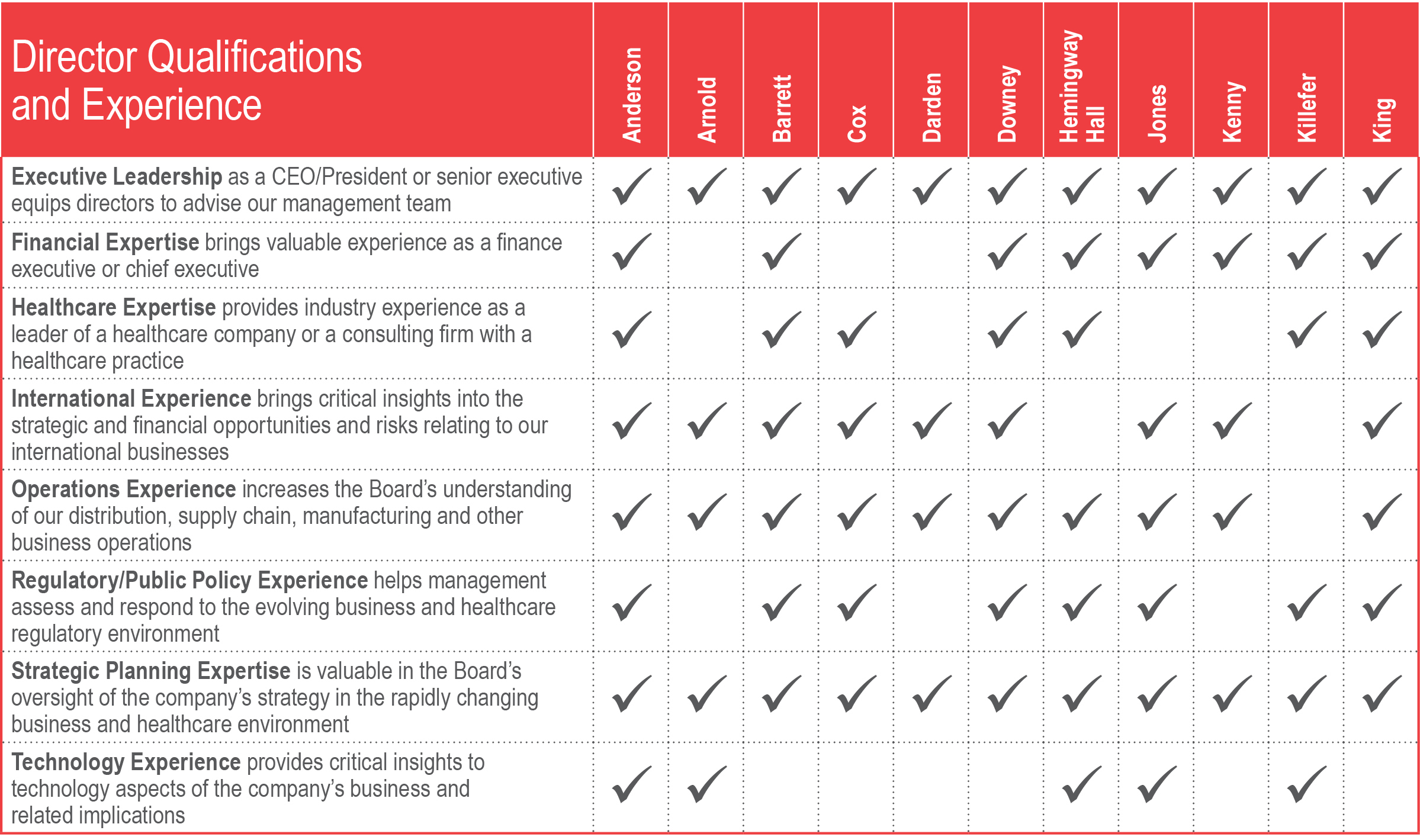

The Board seeks members that possess the experience, skills and diverse backgrounds to perform effectively in overseeing our current and evolving business and strategic direction and to properly perform the Board’s oversight responsibilities. All of our director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have business acumen, healthcare and global business experience and financial expertise, as well as public company board experience. Each of our director nominees has sound judgment and integrity and is able to commit sufficient time and attention to the activities of the Board. All director nominees other than our Chief Executive Officer are independent.

Cardinal Health |2019 Proxy Statement7

Age 62 Director since 2007 Board Committees ● Audit Independent Director | COLLEEN F. ARNOLD | ||

Senior Vice President, Sales and Distribution, International Business Machines Corporation (retired) | |||

Background | |||

Ms. Arnold was Senior Vice President, Sales and Distribution of International Business Machines Corporation (“IBM”), a provider of systems, financing, software and services, from 2014 until 2016. From 1998 to 2014, she held a number of senior positions with IBM, including: Senior Vice President, Application Management Services, IBM Global Business Services; General Manager of GBS Strategy, Global Consulting Services, Global Industries and Global Application Services; General Manager, Europe; General Manager, Australia and New Zealand Global Services; and Chief Executive Officer, Global Services Australia, an IBM joint venture. | |||

Qualifications | |||

A senior executive of IBM for over 15 years, Ms. Arnold’s significant experience in the area of information technology contributes to the Board’s discussions regarding the information security and technology aspects of our business and strategy. Given her extensive international business experience, including leadership of international commercial operations at IBM, she provides valuable insights for our presence in international markets. She has over 30 years of relevant experience in the areas of executive leadership and strategic planning. Ms. Arnold also brings to the Board valuable perspectives and insights from her service on the board of directors of WestRock Company, including its Audit Committee. | |||

Other public company boards | |||

Current WestRock Company | Withinlastfiveyears None | ||

Age 62 Director since 2009 Board Committees ● Human Resources and Compensation ● Ad Hoc Independent Director | CARRIE S. COX | ||

Executive Vice President and President of Global Pharmaceuticals, Schering-Plough Corporation (retired); Chairman and Chief Executive Officer of Humacyte, Inc. (retired) | |||

Background | |||

Ms. Cox served as Chairman and Chief Executive Officer of Humacyte, Inc., a privately held, development stage company focused on regenerative medicine, from 2010 to 2018 and as its Executive Chairman from 2018 to 2019. She was Executive Vice President and President of Global Pharmaceuticals at Schering-Plough Corporation, a multinational branded pharmaceutical manufacturer, from 2003 until its merger with Merck & Co. in 2009. She was Executive Vice President and President of the Global Prescription Business of Pharmacia Corporation, a pharmaceutical and biotechnology company, from 1997 to 2003. | |||

Qualifications | |||

Through her roles as an executive of Schering-Plough, President of Pharmacia’s Global Prescription business and Chief Executive Officer of Humacyte and as a licensed pharmacist, Ms. Cox brings to the Board substantial expertise in healthcare, particularly the branded pharmaceutical and international aspects. She draws on this experience in discussions relating to Pharmaceutical segment strategy, healthcare compliance and the opioid epidemic, including in meetings of the Board’s Ad Hoc Committee. Ms. Cox worked in the global branded pharmaceutical industry for over 30 years, giving her relevant experience with large, multinational healthcare companies in the areas of regulatory compliance, global markets and manufacturing operations. She also brings to the Board and to her role chairing our Human Resources and Compensation Committee, valuable perspectives and insights from her service on the boards of directors of Celgene, electroCore and Texas Instruments and prior service on the Array BioPharma board. She previously served as Chairman of the Board at Array BioPharma and Lead Director at Texas Instruments and currently sits on Texas Instruments’ Compensation Committee and Celgene’s Compensation and Development Committee. | |||

Other public company boards | |||

Current Celgene Corporation electroCore, Inc. Texas Instruments Incorporated | Withinlastfiveyears Array BioPharma Inc. | ||

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 8 |

Age 69 Director since 2005 Board Committees ● Human Resources and Compensation ● Ad Hoc Independent Director | CALVIN DARDEN | ||

Senior Vice President of U.S. Operations of United Parcel Service, Inc. (retired) | |||

Background | |||

Mr. Darden was Senior Vice President of U.S. Operations of United Parcel Service, Inc. (“UPS”), an express carrier and package delivery company, from 2000 until 2005. During his 33-year career with UPS, he served in a number of senior leadership positions, including developing the corporate quality strategy for UPS and leading the business and logistics operations for its Pacific Region, the largest region of UPS at that time. | |||

Qualifications | |||

A former executive of UPS, Mr. Darden has expertise in supply chain networks and logistics that contributes to the Board’s understanding of these important aspects of our business. He has over 30 years of relevant experience in the areas of operations, distribution and supply chain, efficiency and quality control, human resources and labor relations. He also brings to the Board valuable perspectives and insights from his service on the boards of directors of Aramark and Target, including their respective Compensation Committees, as well as his prior service on the board of directors of Coca-Cola Enterprises, including its Human Resources and Compensation Committee. | |||

Other public company boards | |||

Current Aramark Corporation Target Corporation | Withinlastfiveyears Coca-Cola Enterprises, Inc. | ||

Age 71 Director since 2009 Board Committees ● Nominating and Governance ● Ad Hoc Independent Director | BRUCE L. DOWNEY | ||

Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc. (retired); Partner of NewSpring Health Capital II, L.P. | |||

Background | |||

Mr. Downey was Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc., a global generic pharmaceutical manufacturer, from 1994 until 2008 when the company was acquired by Teva Pharmaceutical Industries Ltd. Mr. Downey has served on a part-time basis as a Partner of NewSpring Health Capital II, L.P., a venture capital firm, since 2009. Before his career at Barr Pharmaceuticals, Mr. Downey was a practicing attorney for 20 years, having worked in both private practice and with the U.S. Department of Justice. | |||

Qualifications | |||

Having spent 14 years as Chairman and Chief Executive Officer of Barr Pharmaceuticals, Mr. Downey brings to the Board substantial global experience in the areas of healthcare, regulatory compliance, manufacturing operations, finance, human resources and corporate governance. He offers valuable experience in the pharmaceutical and international aspects of our businesses, and he draws on his extensive legal and healthcare experience in chairing the Ad Hoc Committee and leading Board discussions related to opioid litigation and the opioid epidemic. Mr. Downey also brings to the Board valuable perspectives and insights from his service on the boards of directors of Melinta Therapeutics and Momenta Pharmaceuticals (including as its independent chair). | |||

Other public company boards | |||

Current Melinta Therapeutics, Inc. Momenta Pharmaceuticals, Inc. | Withinlastfiveyears None | ||

Cardinal Health |2019 Proxy Statement9

Age 66 Director since 2013 Board Committees ● Human Resources and Compensation ● Nominating and Governance Independent Director | PATRICIA A. HEMINGWAY HALL | ||

President and Chief Executive Officer of Health Care Service Corporation (retired) | |||

Background | |||

Ms. Hemingway Hall served as President and Chief Executive Officer of Health Care Service Corporation, a mutual health insurer (“HCSC”), from 2008 until 2016. Previously, she held several executive leadership positions at HCSC, including President and Chief Operating Officer from 2007 to 2008 and Executive Vice President of Internal Operations from 2006 to 2007. | |||

Qualifications | |||

As retired President and Chief Executive Officer of HCSC, the largest customer-owned health insurer in the United States operating through several state Blue Cross and Blue Shield Plans, Ms. Hemingway Hall brings to the Board valuable experience regarding evolving healthcare payment models and the regulatory environment in the rapidly changing healthcare industry. She has worked in the healthcare industry for over 30 years, first as a registered nurse and later in health insurance, and has relevant experience in the areas of healthcare reform, regulatory compliance, government relations, finance, information technology and human resources. Ms. Hemingway Hall also brings to the Board and to her roles chairing our Nominating and Governance Committee and being a member of our Human Resources and Compensation Committee, valuable perspectives and insights from her service on the boards of directors of Celgene, Halliburton and ManpowerGroup. She chairs ManpowerGroup’s Nominating and Governance Committee and sits on its Audit Committee, sits on Celgene’s Audit Committee and sits on Halliburton’s Compensation and Nominating and Corporate Governance Committees. | |||

Other public company boards | |||

Current Celgene Corporation Halliburton Company ManpowerGroup Inc. | Withinlastfiveyears None | ||

Age 58 Director since 2018 Board Committees ● Audit Independent Director | AKHIL JOHRI | ||

Executive Vice President and Chief Financial Officer, United Technologies Corporation | |||

Background | |||

Mr. Johri has served as Executive Vice President and Chief Financial Officer of United Technologies Corporation (“UTC”), a provider of high technology products and services to the building systems and aerospace industries, since 2015. From 2013 to 2014, he served as Chief Financial Officer and Chief Accounting Officer of Pall Corporation, a global supplier of filtration, separations and purifications products, and from 2011 to 2013, he was Vice President of Finance and Chief Financial Officer of UTC Propulsion & Aerospace Systems, which included Pratt & Whitney and UTC Aerospace Systems. Mr. Johri’s prior roles with UTC include leading investor relations, as well as holding senior financial roles with global business units, including 12 years in the Asia Pacific Region. | |||

Qualifications | |||

Having spent more than 25 years in financial leadership positions with UTC and Pall Corporation, Mr. Johri brings to the Board substantial experience in the areas of global finance and accounting, investor relations, mergers and acquisitions, information technology and international markets. Drawing upon his financial expertise, he provides valuable insights in the areas of financial reporting, accounting, internal controls and capital markets, as well as international tax and finance. Through his experience in senior leadership roles with UTC’s businesses, he provides a deep understanding of the financial aspects of, and capital deployment for, a publicly traded multinational company. | |||

Other public company boards | |||

Current None | Withinlastfiveyears None | ||

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 10 |

Age 56 Director since 2018 | MICHAEL C. KAUFMANN | ||

Chief Executive Officer, Cardinal Health, Inc. | |||

Background | |||

Mr. Kaufmann has served as Chief Executive Officer of Cardinal Health since January 2018. From November 2014 to December 2017, he served as our Chief Financial Officer and from August 2009 to November 2014, he served as our Chief Executive Officer — Pharmaceutical Segment. Prior to that, he held a range of other senior leadership roles here spanning operations, sales and finance, including in both our Pharmaceutical and Medical segments. | |||

Qualifications | |||

As our Chief Executive Officer and having spent almost 30 years at Cardinal Health, Mr. Kaufmann draws on his deep knowledge of our daily operations and our industry, customers, suppliers, employees and shareholders to provide the Board with a unique and very important perspective on our business and a conduit for information from management. Prior leadership positions across the company provide him with expertise in the areas of healthcare, distribution operations, finance, international markets, mergers and acquisitions and regulatory compliance. He also provides the Board with an understanding of the strategic and financial implications of business, regulatory and economic factors impacting our company from having played an important role in key strategic initiatives, including the Red Oak Sourcing joint venture with CVS Health. In addition, Mr. Kaufmann brings relevant experience and perspectives to the Board from his service on the board of directors of MSC Industrial Direct, including its Audit and Compensation Committees. | |||

Other public company boards | |||

Current MSC Industrial Direct Co., Inc. | Withinlastfiveyears None | ||

Age 66 Director since 2007 Board Committees ● Nominating and Governance ● Ad Hoc Independent Chairman of the Board | GREGORY B. KENNY | ||

President and Chief Executive Officer of General Cable Corporation (retired) | |||

Background | |||

Mr. Kenny served as President and Chief Executive Officer of General Cable Corporation, a global manufacturer of aluminum, copper and fiber-optic wire and cable products, from 2001 until 2015. Prior to that, he was President and Chief Operating Officer of General Cable from 1999 to 2001 and Executive Vice President and Chief Operating Officer from 1997 to 1999. Mr. Kenny previously served in executive level positions at Penn Central Corporation, where he was responsible for corporate business strategy, and in diplomatic service as a Foreign Service Officer with the U.S. Department of State. | |||

Qualifications | |||

Mr. Kenny, who has been our Chairman of the Board since November 2018, brings to the Board significant experience in the areas of board leadership, corporate governance, manufacturing operations, international markets, finance and human resources. He also draws upon his board governance and leadership experience previously chairing our Nominating and Governance and Human Resources and Compensation Committees and chairing Ingredion’s board of directors and its Corporate Governance and Nominating Committee. Both in his current role as Chairman of the Board and his prior role as independent Lead Director, Mr. Kenny has promoted strong independent Board leadership and a robust, deliberative decision-making process among independent directors. Mr. Kenny also brings to the Board valuable perspectives and insights from his service on AK Steel’s board of directors. | |||

Other public company boards | |||

Current AK Steel Holding Corporation Ingredion Incorporated | Withinlastfiveyears General Cable Corporation | ||

Cardinal Health |2019 Proxy Statement11

Age 65 Director since 2015 Board Committees ● Human Resources and Compensation Independent Director | NANCY KILLEFER | ||

Senior Partner, Public Sector Practice, McKinsey & Company, Inc. (retired) | |||

Background | |||

Ms. Killefer served as Senior Partner of McKinsey & Company, Inc., a global management consulting firm, from 1992 until 2013. She joined McKinsey in 1979 and held a number of key leadership roles, including serving as a member of the firm’s governing board. Ms. Killefer founded McKinsey’s Public Sector Practice in 2007 and served as its managing partner until her retirement. She also served as Assistant Secretary for Management, Chief Financial Officer and Chief Operating Officer for the U.S. Department of Treasury from 1997 to 2000. | |||

Qualifications | |||

Having served in key leadership positions in both the public and private sectors and provided strategic counsel to healthcare and consumer-based companies during her 30 years with McKinsey, Ms. Killefer brings to the Board substantial experience in the areas of strategic planning, including healthcare strategy, and marketing and brand-building. Her extensive experience as managing partner of McKinsey’s Public Sector Practice and as a chief financial officer of a government agency provides valuable insights in the areas of government relations, public policy and finance. Ms. Killefer also brings to the Board valuable perspectives and insights from her service on the board of directors of Avon Products, including its Compensation and Management Development Committee, and Taubman Centers and her prior service on the boards of directors of CSRA, Inc. (including as its independent chair), Computer Sciences Corporation and The Advisory Board. | |||

Other public company boards | |||

Current Avon Products, Inc. Taubman Centers, Inc. | Withinlastfiveyears CSRA, Inc. Computer Sciences Corporation The Advisory Board Company | ||

Age 73 Director since December 2018 (previously 1996 – 2009) Board Committees ● Audit Independent Director | J. MICHAEL LOSH | ||

Executive Vice President and Chief Financial Officer of General Motors Corporation (retired) | |||

Background | |||

Mr. Losh served as Executive Vice President and Chief Financial Officer of General Motors Corporation, a global automobile manufacturer, from 1994 to 2000. He spent 36 years in various capacities with General Motors. Mr. Losh also previously served as our interim Chief Financial Officer from July 2004 to May 2005 and was a director of Cardinal Health from 1996 through our spin-off of CareFusion Corporation in 2009. | |||

Qualifications | |||

We elected Mr. Losh to the Board due to his immediate ability to chair our Audit Committee based on his financial expertise and prior service on our Board. Mr. Losh brings a deep financial background, industry knowledge from his prior service on our and CareFusion’s boards, and extensive public company board experience in a variety of industries. He is former Chief Financial Officer of General Motors, chairs Aon’s Audit Committee and previously chaired the Audit Committees at Prologis, CareFusion and TRW. He also currently chairs Masco’s board of directors and Corporate Governance and Nominating Committee and previously served as CareFusion’s Presiding Director. In light of our director retirement age of 75, he is expected to serve no more than a few years. While Mr. Losh previously served on our Board, he resigned to join the board of our CareFusion spin-off 10 years ago. During that 10-year period, the entire executive team and most of the Board have changed. | |||

Other public company boards | |||

Current Amesite Inc. (not publicly traded(1)) Aon plc H.B. Fuller Corporation Masco Corporation Prologis, Inc. | Withinlastfiveyears CareFusion Corporation TRW Automotive Holdings Corp | ||

Amesite has registered securities with the U.S. Securities and Exchange Commission under Section 12(g) of the Securities Exchange Act of 1934 and became subject to the reporting obligations of that Act, but we do not view Amesite as a “public company” for governance purposes because Amesite’s securities currently are not listed on any stock exchange or quoted on an over-the-counter market.

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 12 |

Age 63 Director since September 2019 Board Committees ● Audit Independent Director | DEAN A. SCARBOROUGH | ||

Chairman and Chief Executive Officer, Avery Dennison Corporation (retired) | |||

Background | |||

Mr. Scarborough served as Chairman and Chief Executive Officer of Avery Dennison Corporation, a packaging and labeling solutions company, from 2014 to 2016. Prior to that, he served as Avery Dennison’s Chairman, President and Chief Executive Officer from 2010 to 2014 and as its President and Chief Executive Officer from 2005 to 2010. After stepping down as Chief Executive Officer, Mr. Scarborough remained Chairman of the Board through April 2019. Having joined Avery Dennison in 1983, Mr. Scarborough served in a series of leadership roles both in the United States and abroad until he was appointed Chief Operating Officer in 2000 and later Chief Executive Officer. | |||

Qualifications | |||

Having served as Avery Dennison’s Chief Executive Officer for 11 years, Mr. Scarborough brings to the Board substantial experience in manufacturing and distribution operations. As a former public company chief executive officer, he has relevant experience in finance, human resources and corporate governance. He also brings a global business and manufacturing perspective, having led Avery Dennison’s Label and Packaging Materials Europe business while he was based in the Netherlands. Mr. Scarborough also brings to the Board valuable perspectives and insights from his service on the board of directors of Graphic Packaging Holding Company, including its Audit Committee, and prior service on Mattel, Inc.’s board of directors. | |||

Other public company boards | |||

Current Graphic Packaging Holding Company | Withinlastfiveyears Avery Dennison Corporation | ||

Age 63 Director since September 2019 Board Committees ● Audit Independent Director | JOHN H. WEILAND | ||

President and Chief Operating Officer, C. R. Bard, Inc. (retired) | |||

Background | |||

Mr. Weiland served as President and Chief Operating Officer of medical device company C. R. Bard, Inc. from 2003 until 2017, when Bard was acquired by Becton, Dickinson and Company. He also served on Bard’s board of directors from 2005 to 2017, becoming Vice Chairman of the Board in 2016. Mr. Weiland joined Bard in 1996 and held the position of Group President, with global responsibility for several Bard divisions and its worldwide manufacturing operations prior to becoming President and Chief Operating Officer. Prior to Bard, he held senior management positions at Dentsply International, American Hospital Supply, Baxter Healthcare and Pharmacia AB. | |||

Qualifications | |||

Mr. Weiland brings over 40 years of healthcare industry experience to the Board, including executive leadership at a medical device company and significant international business experience. He has relevant experience in regulatory compliance, global markets and manufacturing operations. Mr. Weiland also brings to the Board valuable perspectives and insights from his service on the board of directors of Celgene Corporation, including its Audit Committee, and prior service on West Pharmaceutical Services’ board of directors, including chairing its Compensation and Finance Committees. | |||

Other public company boards | |||

Current Celgene Corporation | Withinlastfiveyears C. R. Bard, Inc. West Pharmaceutical Services, Inc. | ||

Cardinal Health |2019 Proxy Statement13

Our director nominees possess relevant skills and experience that contribute to a well-functioning Board that effectively oversees our strategy and management.

Director Nominee Skills and Experience | Arnold | Cox | Darden | Downey | Hemingway Hall | Johri | Kaufmann | Kenny | Killefer | Losh | Scarborough | Weiland | |

Boardleadership as a board chair, lead director or committee chair equips directors to lead our Board and its Committees | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

Financialexpertise as a finance executive or CEO brings valuable experience to the Board and our management team | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

Healthcareexpertise as a leader of a healthcare company or a consulting firm with a healthcare practice provides industry experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||

Operationsexperience increases the Board’s understanding of our distribution and manufacturing operations | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

Regulatory/legal/publicpolicyexperience helps the Board assess and respond to an evolving business and healthcare regulatory environment | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Internationalexperience brings critical insights into the opportunities and risks of our international businesses | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

Informationtechnologyexperience contributes to the Board’s understanding of the information technology aspects of our business | ✓ | ✓ | ✓ |

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 14 |

Our Board’s Composition and Structure

Our Board Leadership Structure

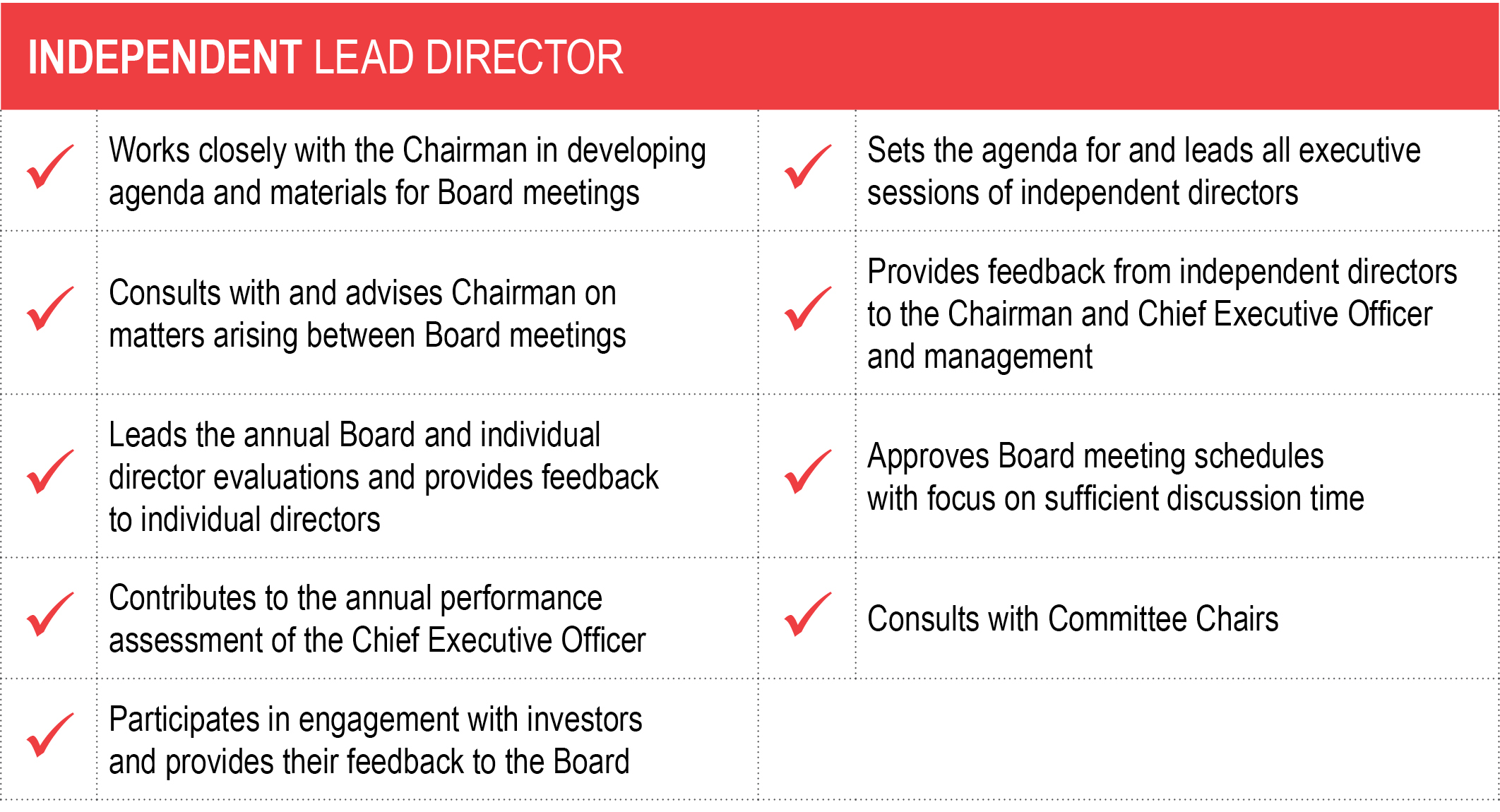

Mr. Kenny has served as the independent, non-executive Chairman of the Board since November 2018, when we separated the Chairman and Chief Executive Officer roles. In addition to serving as a liaison between the Board and management, key responsibilities of the Chairman include:

calling meetings of the Board and independent directors;

setting the agenda for Board meetings in consultation with the other directors, the Chief Executive Officer and the corporate secretary;

reviewing Board meeting materials before circulation;

chairing Board meetings, including the executive sessions of the independent directors;

participating in the annual Chief Executive Officer performance evaluation;

acting as an advisor to Mr. Kaufmann on strategic aspects of the Chief Executive Officer role, with regular consultations on major developments and decisions; and

holding governance discussions with large investors.

The Board considered a wide range of factors in determining that its current leadership structure is the most appropriate arrangement at the present time, including current market practice and the views of shareholders. The Nominating and Governance Committee periodically reviews, assesses and makes recommendations to the Board regarding the Board’s leadership structure.

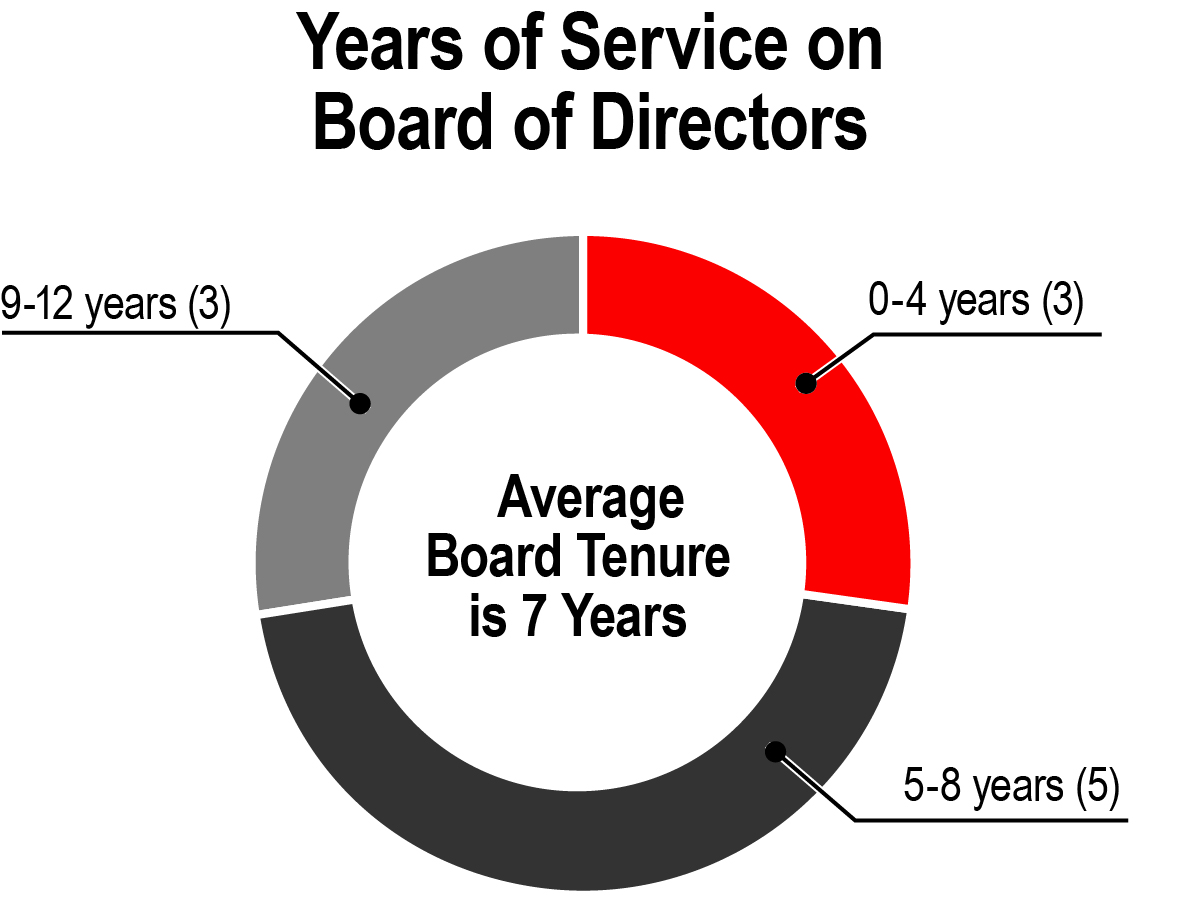

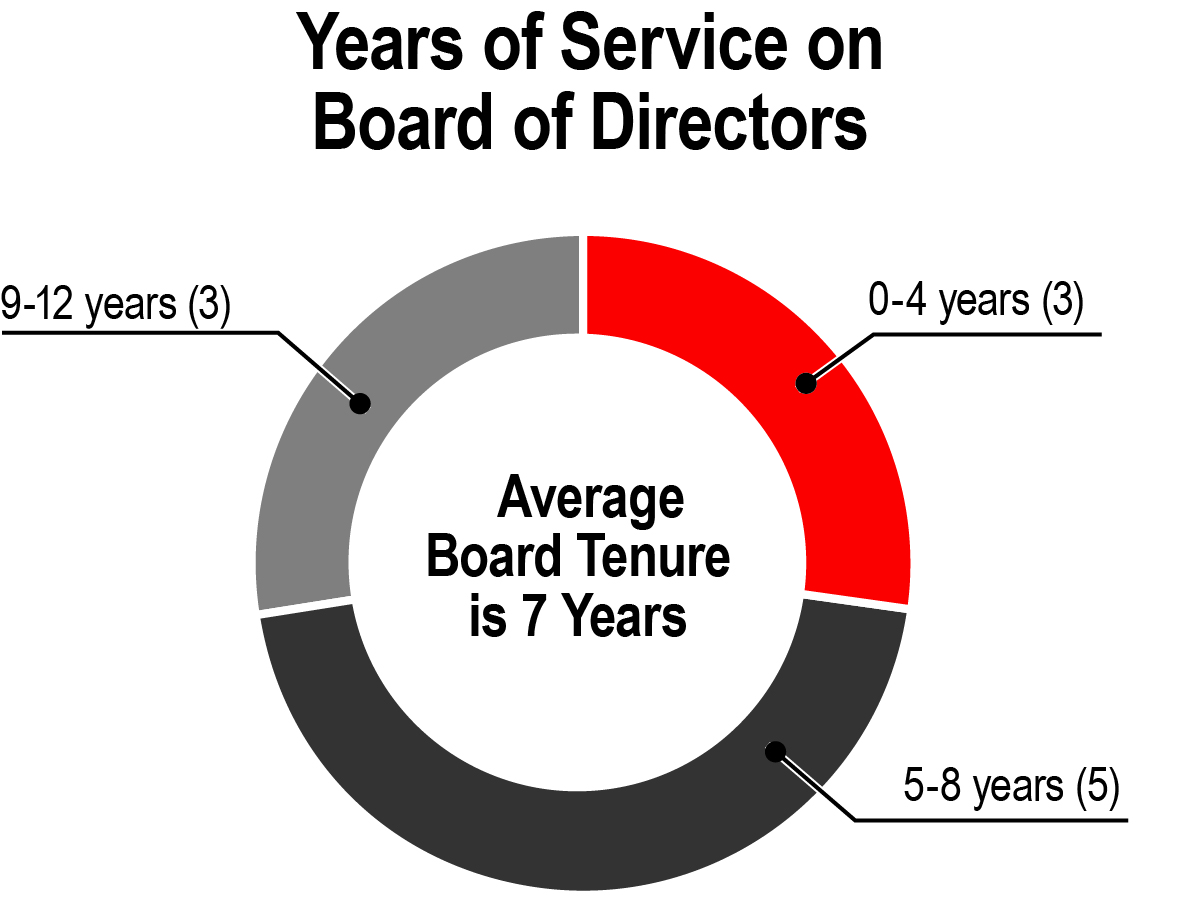

Our Corporate Governance Guidelines provide that the Board should be diverse, engaged and independent. In identifying and evaluating candidates for the Board, the Nominating and Governance Committee considers the diversity of the Board, including diversity of skills, experience and backgrounds, as well as ethnic and gender diversity. We believe that our Board nominees reflect an appropriate mix of skills, experience and backgrounds and strike the right balance of longer serving and newer directors.

Does not include Mr. Losh’s prior service on our Board from 1996 to 2009.

Cardinal Health |2019 Proxy Statement15

How We Identify, Add and On-Board New Directors

The Nominating and Governance Committee is responsible for identifying, reviewing and recommending director candidates and our Board is responsible for selecting candidates for election as directors based on the Nominating and Governance Committee’s recommendations.

While the process may vary depending on the director candidate, our general approach is the following:

Mr. Kenny identified Mr. Losh as a potential candidate for consideration by the Nominating and Governance Committee. Mr. Losh had the immediate ability to chair our Audit Committee, based on his financial expertise and prior service on our Board, after two key Audit Committee members, including the former chair, left the Board last Fall. In addition, Mr. Losh brings extensive public company board experience.

A search firm retained by the Nominating and Governance Committee identified Mr. Scarborough, and Mses. Cox and Hemingway Hall, who serve on the Celgene board of directors with him, identified Mr. Weiland, as potential candidates for consideration by the Nominating and Governance Committee. Mr. Scarborough brings to the Board substantial experience as a former public company Chief Executive Officer with manufacturing and distribution operations experience. Mr. Weiland has executive leadership experience at a medical device company, as well as significant international business experience.

New directors participate in a comprehensive, full-day director orientation program, which includes meetings with senior management. This orientation program helps new directors become familiar with our business and strategy, significant financial matters, ethics and compliance program, corporate governance practices and risk management and human resources functions.

The Board held six meetings during fiscal 2019. Each director attended 75% or more of the meetings of the Board and Board committees on which he or she served during the fiscal year.

All of our directors at the time attended the 2018 Annual Meeting of Shareholders. Absent unusual circumstances, each director is expected to attend the Annual Meeting of Shareholders.

The Board has an Audit Committee, a Nominating and Governance Committee and a Human Resources and Compensation Committee (the “Compensation Committee”). Each member of these committees is independent under our Corporate Governance Guidelines and under applicable committee independence rules.

The charter for each of these committees is available on our website at www.cardinalhealth.com under “About Us — Corporate — Investor Relations — Corporate Governance — Board Committees and Charters.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

The Board also has an Ad Hoc Committee of independent directors formed in 2018 to assist the Board in its oversight of opioid-related issues.

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 16 |

Members:(1) J. Michael Losh (Chair)(2) Colleen F. Arnold(3) Akhil Johri Dean A. Scarborough(4) John H. Weiland(4) Meetings in fiscal 2019:6 | The Audit Committee’s primary duties are to: ● oversee the integrity of our financial statements, including reviewing annual and quarterly financial statements and earnings releases and the effectiveness of our internal and disclosure controls; ● appoint the independent auditor and oversee its qualifications, independence and performance, including pre-approving all services by the independent auditor; ● review our internal audit plan and oversee our internal audit department; ● approve the appointment of our Chief Legal and Compliance Officer and oversee our ethics and compliance program and our compliance with applicable legal and regulatory requirements; and ● oversee our major financial and information technology risk exposures and our process for assessing and managing risk through our enterprise risk management program. The Board has determined that each of Messrs. Johri, Losh and Scarborough is an “audit committee financial expert” for purposes of the U.S. Securities and Exchange Commission (“SEC”) rules. |

Nominating and Governance Committee

Members: Patricia A. Hemingway Hall (Chair)(5) Bruce L. Downey(6) Gregory B. Kenny Meetings in fiscal 2019:4 | The Nominating and Governance Committee’s primary duties are to: ● identify, review and recommend candidates for the Board, including recommending criteria to the Board for potential Board candidates and assessing the qualifications, attributes, skills, contributions and independence of individual directors and director candidates; ● oversee the Board’s succession planning; ● make recommendations to the Board concerning the structure, composition and functions of the Board and its Committees, including Board leadership and leadership structure; ● review our Corporate Governance Guidelines and governance practices and recommend changes; ● oversee our environmental sustainability and other corporate citizenship activities, including our policies and practices regarding political expenditures; and ● conduct the annual Board evaluation and oversee the process for the evaluation of each director. |

Clayton M. Jones served as chair of the Audit Committee until his term expired at the 2018 Annual Meeting of Shareholders. David J. Anderson served on the Audit Committee until he resigned from the Board in September 2018. Mr. Downey served on the Audit Committee until September 2019.

Mr. Losh became chair of the Audit Committee in December 2018 when he joined the Board.

Ms. Arnold became a member of the Audit Committee in November 2018. She served on the Nominating and Governance Committee until November 2018.

Messrs. Scarborough and Weiland became members of the Audit Committee in September 2019.

Ms. Hemingway Hall became chair of the Nominating and Governance Committee in November 2018.

Mr. Downey became a member of the Nominating and Governance Committee in November 2018.

Cardinal Health |2019 Proxy Statement17

Human Resources and Compensation Committee

Members:(1) Carrie S. Cox (Chair)(2) Calvin Darden Patricia A. Hemingway Hall(3) Nancy Killefer Meetings in fiscal 2019:7 | The Compensation Committee’s primary duties are to: ● approve compensation for the Chief Executive Officer, establish relevant performance goals and evaluate his performance; ● approve compensation for our other executive officers and oversee their evaluations; ● make recommendations to the Board with respect to the adoption of equity and incentive compensation plans and administer such plans; ● review our non-management directors’ compensation program and recommend changes to the Board; ● oversee the management succession process for the Chief Executive Officer and senior executives; ● oversee workplace diversity and inclusion initiatives and progress; ● oversee and assess material risks related to compensation arrangements; and ● assess the independence of Compensation Committee’s consultant and evaluate its performance. The Compensation Discussion and Analysis, which begins on page 30, discusses how the Compensation Committee makes compensation-related decisions regarding our named executive officers. |

Members: Bruce L. Downey (Chair) Carrie S. Cox Calvin Darden Gregory B. Kenny Meetings in fiscal 2019:9 | The Ad Hoc Committee assists the Board in its oversight of Cardinal Health’s response to the nationwide problem of prescription opioid abuse. It receives and discusses regular reports from management and our external advisors on our initiatives and other developments and provides management input and direction. It also provides advice, regular reports and recommendations to the Board. The Ad Hoc Committee receives updates regarding, among other things: ● investigations and litigation, including the Multi-District Litigation before Judge Polster in Ohio, with the first trial scheduled for October 2019, and related discussions of possible litigation resolutions; ● anti-diversion and controlled substance reporting programs; ● risks posed to Cardinal Health by the opioid epidemic and related litigation from a legal, financial and reputational perspective; ● changes in the regulatory and legislative environment; ● Cardinal Health’s Opioid Action Program; and ● engagement with shareholders, employees, public officials and other key stakeholders. |

| (1) | David P. King served as chair of the Compensation Committee until November 2018. |

| (2) | Ms. Cox became chair of the Compensation Committee in November 2018. |

| (3) | Ms. Hemingway Hall became a member of the Compensation Committee in November 2018. |

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 18 |

Our Board’s Primary Role and Responsibilities and Processes

Our Board’s Primary Role and Responsibilities

Our Corporate Governance Guidelines provide that our Board serves as the representative of, and acts on behalf of, all the shareholders of Cardinal Health. In that regard, some primary functions of the Board include:

reviewing, evaluating and, where appropriate, approving our major business strategies, capital deployment and long-term plans and reviewing our performance;

planning for and approving management succession; and

overseeing our policies and procedures for assessing and managing compliance and risk.

How our Board Oversees Our Strategy and Capital Deployment

The Board receives updates on company performance and regularly discusses our strategy considering the competitive environment, developments in the rapidly changing healthcare industry and the global business and economic environment. The Board reviews and approves capital deployment, including dividends, financing and share repurchase plans, and significant acquisitions and divestitures.

At least annually, the Board conducts a dedicated strategy session with in-depth discussions of our industry, specific businesses and new business opportunities. At these sessions, the Board discusses risks related to our strategies, including risks resulting from possible competitor, customer and supplier actions. The Board also considers various elements of strategy at each regular quarterly meeting. The collective backgrounds, skills and experiences of our directors, including broad industry experience, contribute to robust discussions of strategy and the related risks.

As a recent example of our Board’s oversight and engagement in these areas, the Board and management had been conducting a comprehensive review of our portfolio, cost structure and capital deployment. The Board was actively engaged in this process with detailed analyses and extensive discussions. These strategic initiatives include:

Coststructure: fundamental review of how we operate;

Cordis: repositioning the business for growth;

PatientRecovery: successfully integrating and operating the business;

Pharmaceuticaldistributionbusinessmodel: evaluating the upstream and downstream elements of the business model;

Portfolioandpartnerships: simplifying our portfolio of businesses and expanding in critical spaces; and

Capitaldeployment: being disciplined and thoughtful in our approach.

Management has provided updates to investors on the costs savings achieved and progress on other strategic initiatives in its quarterly earnings calls with investors.

Early in fiscal 2019, we entered into a partnership with Clayton, Dubilier & Rice, LLC for our naviHealth business. The Board had reviewed and discussed strategic alternatives for this business and approved the transaction in fiscal 2018. The investment structure provides naviHealth with the resources needed to support and accelerate its growth trajectory.

Cardinal Health |2019 Proxy Statement19

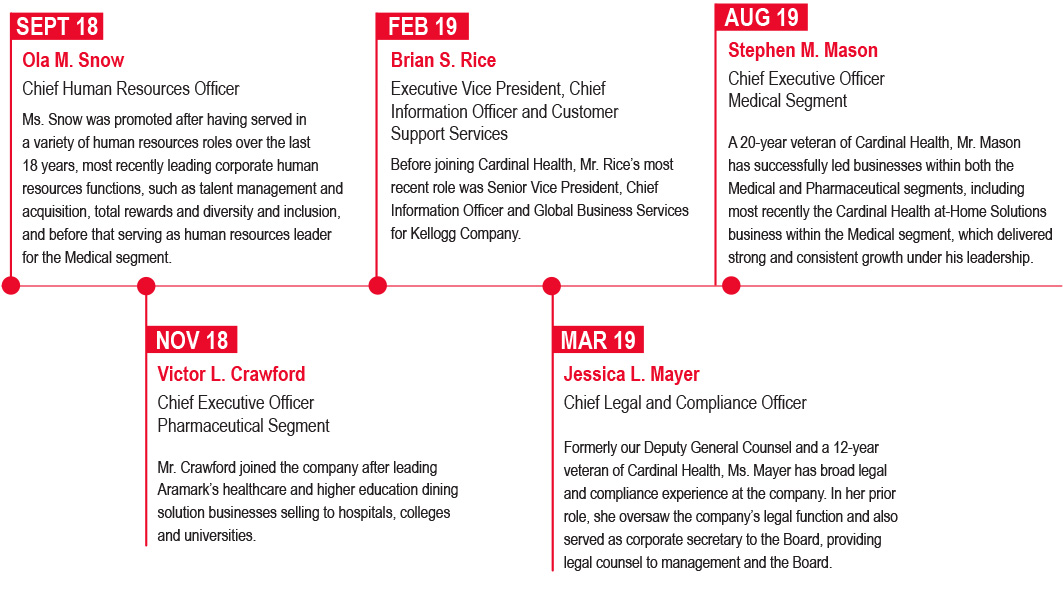

How our Board Engages in Management Succession

The Compensation Committee and the Board are actively engaged in our talent management program. The Compensation Committee oversees the process for succession planning for the Chief Executive Officer and other senior executives, and management provides an organizational update at each quarterly Compensation Committee meeting.

The full Board holds a formal succession planning and talent review session annually, which includes succession planning for the Chief Executive Officer and other senior executives. These sessions include identification of internal candidates and desired leadership skills and key capabilities and experience in light of our current and evolving business and strategic direction.

Directors interact with our leaders through Board presentations and discussions, as well as through informal events and planned one-on-one sessions.

The Board maintains an emergency succession plan, as well as a long-term succession plan for the position of Chief Executive Officer.

Since the beginning of fiscal 2019, our succession planning process has helped Mr. Kaufmann build his executive leadership team with both seasoned Cardinal Health veterans and highly experienced new hires. In addition, David C. Evans joined us in September 2019 as interim Chief Financial Officer while we are conducting an external search for a permanent Chief Financial Officer.

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 20 |

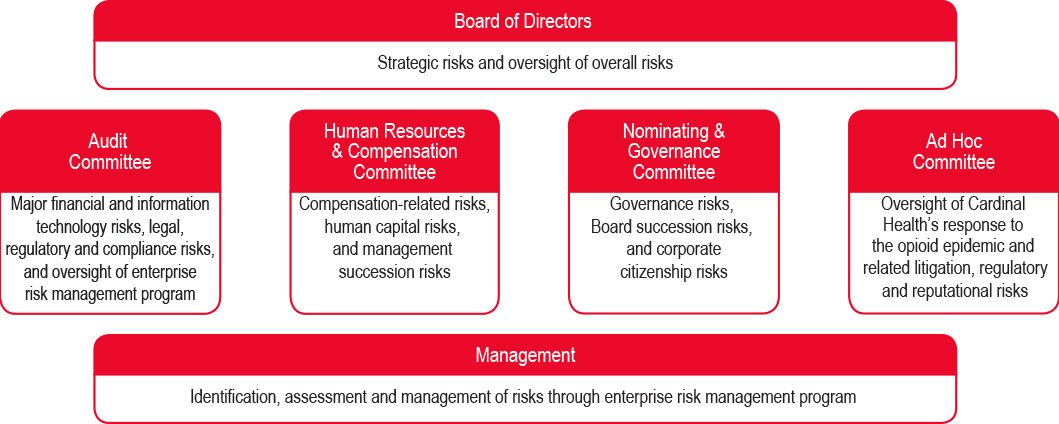

A summary of the allocation of general risk oversight functions among management, the Board and its Committees is as follows:

Management has day-to-day responsibility for assessing and managing risks, and the Board is responsible for risk oversight. Management has developed and administers an enterprise risk management program, which the Audit Committee oversees. Through this process, management identifies and prioritizes enterprise risks and develops systems to assess, monitor and mitigate those risks. Management reviews and discusses with the Board significant risks identified through this program.

The Audit Committee is responsible for discussing with management major financial risk exposures, our ethics and compliance program and compliance with legal and regulatory requirements. The Board and Audit Committee receive regular updates on our ethics and compliance and cybersecurity programs. During fiscal 2019, the Board received a report on an information technology risk assessment conducted by a third-party highlighting program strengths, risks and recommendations and is monitoring implementation of recommended actions.

In connection with its risk oversight role, the Audit Committee meets regularly with representatives from our independent auditor and with our Chief Financial Officer, Chief Legal and Compliance Officer and the head of our internal audit function.

The Ad Hoc Committee assists the Board in its oversight of our response to the opioid epidemic. The Ad Hoc Committee receives updates and assesses the implications for Cardinal Health of, among other things, the risks posed by the opioid epidemic and related litigation from a legal, financial and reputational perspective.

Our Ethics and Compliance Program

Our Board has adopted written StandardsofBusinessConduct that outline our corporate values and standards of integrity and behavior. The StandardsofBusinessConduct are designed to foster a culture of integrity, drive compliance with legal and regulatory requirements, and protect and promote the reputation of our company. The full text of the StandardsofBusinessConductis posted on our website at www.cardinalhealth.com under “About Us — Who we are — Ethics and Compliance.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

Our Chief Legal and Compliance Officer has responsibility to implement and maintain an effective ethics and compliance program. She provides quarterly updates on our ethics and compliance program to the Audit Committee and an update to the full Board at least once a year, or more frequently as needed. She reports to the Chairman of the Audit Committee and to the Chief Executive Officer and meets in executive session quarterly with the Audit Committee.

Cardinal Health |2019 Proxy Statement21

The Board’s Role in Oversight of Corporate Citizenship

The Nominating and Governance Committee is charged with overseeing our environmental sustainability and other corporate citizenship activities, including our policies and practices regarding political expenditures. Our corporate citizenship reports are available on our website at www.cardinalhealth.com under “About Us — Corporate Citizenship.”

The Board’s Role in Oversight of Corporate Culture

In line with the growing interest from shareholders in corporate culture, the Board continues to assess and monitor corporate culture at Cardinal Health and how it fosters our business strategies. To inform the Board about our human capital and cultural health, we developed a cross-functional culture scorecard that we share with the Board annually. The scorecard includes employee engagement survey data, employee turnover, diverse employee and management representation, business conduct line data and employee health and safety measures.

As part of our broader strategic and financial plans, we began fiscal 2020 by clarifying for our employees what we are calling “Our Path Forward,” which outlines both the plans and initiatives we have underway to advance our objectives and the key competitive advantages and values that will be vital to our success.

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 22 |

Each year, our Board conducts a rigorous self-evaluation process, which usually includes individual director evaluations. This process is overseen by the Nominating and Governance Committee, led by our Nominating and Governance Committee Chair and conducted by an outside facilitator with corporate governance experience. The outside facilitator interviews each director to obtain anonymous feedback regarding the Board’s performance and effectiveness. This feedback helps the Board identify follow-up items and provide feedback to management.

The Board evaluation process includes an assessment of both Board process and substance, including:

the Board’s effectiveness, structure, composition, succession and culture;

the quality of Board discussions;

the Board’s performance in oversight of business performance, strategy, succession planning, risk management, ethics and compliance and other key areas; and

agenda topics for future meetings.

The outside facilitator also obtains feedback regarding each individual director, which is provided to the director in individual discussion. The Board believes that this annual evaluation process supports its effectiveness and continuous improvement.

In addition to the full Board’s evaluation process, each of the Audit, Compensation and Nominating and Governance Committees annually review their charters and conduct their own Committee self-evaluation.

The Board has established director independence standards based on the New York Stock Exchange (“NYSE”) rules. These standards can be found in our Corporate Governance Guidelines on our website at www.cardinalhealth.com under “About Us — Corporate — Investor Relations — Corporate Governance — Corporate Governance Documents.” These standards address, among other things, employment and compensation relationships, relationships with our auditor and customer and business relationships.

The Board assesses director independence at least annually, based on the recommendations of the Nominating and Governance Committee. The Board has determined that each of Messrs. Darden, Downey, Johri, Kenny, Losh, Scarborough and Weiland, and each of Mses. Arnold, Cox, Hemingway Hall and Killefer, is independent.

Mr. Anderson, who served on our Board until September 2018, and Messrs. Jones and King, who served on our Board until our 2018 Annual Meeting of Shareholders, were determined to be independent as disclosed in our proxy statement for the 2018 Annual Meeting of Shareholders.

Cardinal Health |2019 Proxy Statement23

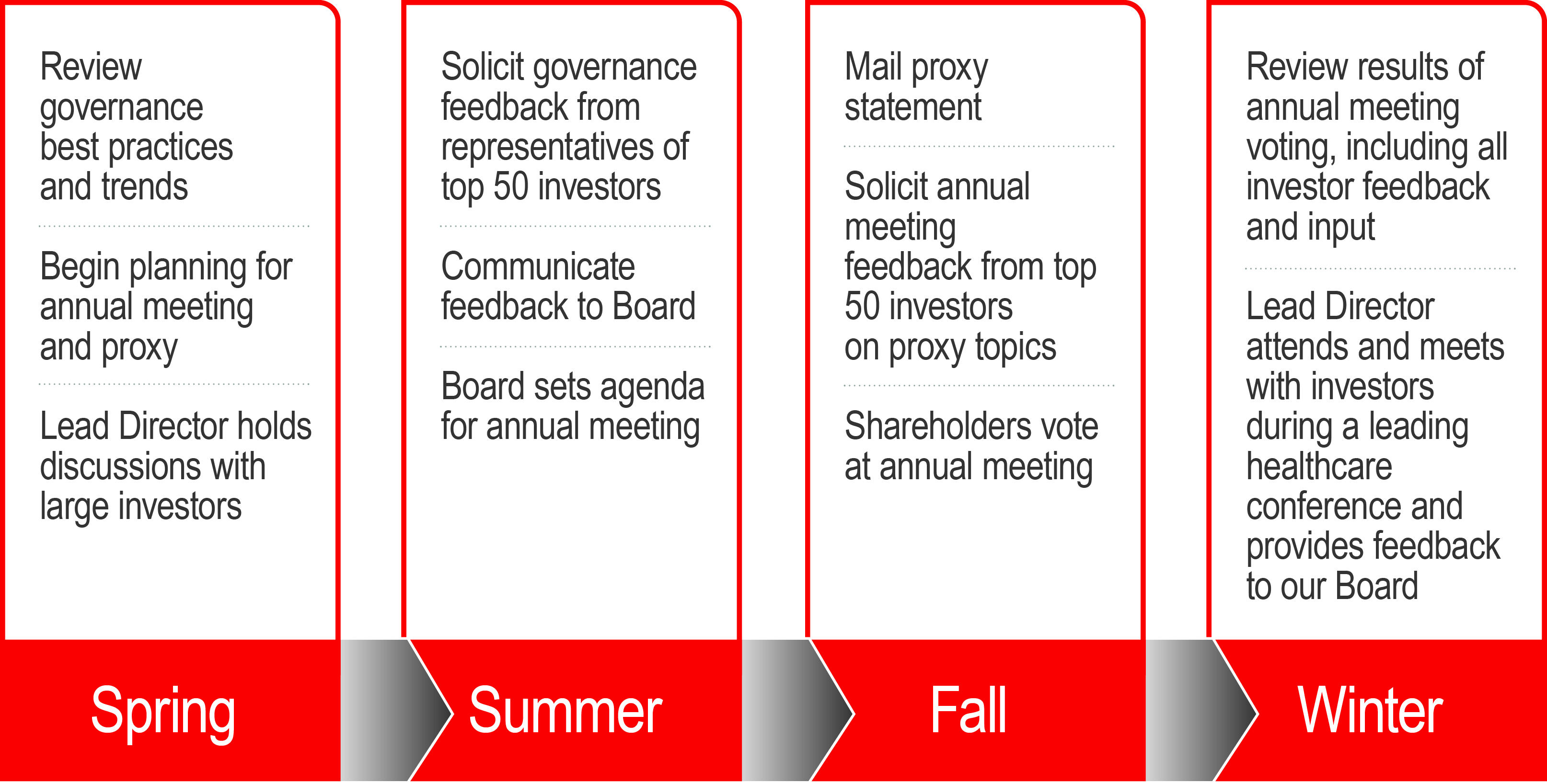

It has been our long-standing practice to actively engage with our shareholders throughout the year so that management and the Board can better understand shareholder perspectives on governance, executive compensation and other topics. We strive for a collaborative approach to engagement and value shareholders’ perspectives.

During fiscal 2019, we again engaged with governance professionals from our largest shareholders. Our engagement discussions covered, among other topics, our Board’s composition and leadership changes, the Board’s oversight of our response to the opioid epidemic and related litigation, the Board’s engagement in the comprehensive strategic review, our executive transitions and our human capital management programs and corporate culture. We also continued to hold constructive discussions with members of the Investors for Opioid Accountability coalition.

A general overview of our annual engagement process is below.

After considering feedback from shareholders in recent years, we have:

separated the Chairman of the Board and Chief Executive Officer roles;

increased our communications about the Ad Hoc Committee and the Board’s oversight of opioid-related issues;

enhanced our disclosures regarding how we identify, add and on-board new directors;

added a Chairman’s letter to our proxy statement;

enhanced our executive compensation clawback provision;

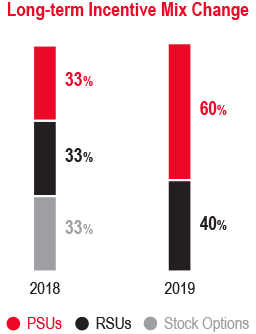

changed the long-term incentive compensation mix for executives, increasing the proportion of performance share units (“PSUs”) to 60% and eliminating stock options; and

adopted a policy to explain the exclusion of certain legal and compliance costs from our incentive performance metrics and give a breakdown of any such excluded costs.

We received a shareholder proposal for the 2018 Annual Meeting of Shareholders to reduce the share ownership threshold to call a special meeting of shareholders from its current 25% to 10%. The proposal failed on a close vote. Given the close vote, we asked shareholders during our fiscal 2019 engagement whether they thought we should consider changing our ownership threshold. Views were mixed with many supporting our current threshold and some suggesting that we consider reducing it. We determined based on this feedback and the majority vote against last year’s proposal that maintaining our existing 25% ownership threshold continues to be appropriate, but we continue to discuss this matter with shareholders and monitor developing practices.

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 24 |

Our non-management director compensation program is approved by our Board based on the recommendation of the Compensation Committee. The Compensation Committee receives comparative market data and recommendations from its compensation consultant with regard to the structure and amounts of our director compensation. Total director compensation is targeted at the median amount among our Comparator Group, which is discussed on page 36.

Following the Compensation Committee’s most recent review of director compensation in May 2019, and based on the recommendation of its compensation consultant, the Compensation Committee recommended to the Board, and the Board approved, increases to the annual retainers and restricted share unit (“RSU”) grants effective in November 2019. The new compensation aligns with our target of the median director compensation for the Comparator Group.

In November 2018, the Compensation Committee had recommended to the Board, and the Board approved, prorated grants of RSUs to directors when they are first elected to the Board to align with market practice.

The table below shows the elements and amount of compensation that we pay to our non-management directors.

Compensation Element | Amount before November 7, 2018 ($) | Amount from November 7, 2018 to November 5, 2019 ($) | Amount on and after November 6, 2019 ($) |

Annual retainer(1) | 100,000 | 105,000 | 115,000 |

RSUs(2) | 160,000 | 175,000 | 185,000 |

Committee chair annual retainer(1) |

|

|

|

Audit Committee | 20,000 | 25,000 | 25,000 |

Compensation Committee | 15,000 | 20,000 | 20,000 |

Nominating and Governance Committee | 10,000 | 15,000 | 15,000 |

Lead Director compensation |

|

|

|

Annual retainer(1) | 20,000 | – | – |

Annual RSUs | 20,000 | – | – |

Non-executive Chairman of the Board compensation |

|

|

|

Annual retainer(1) | – | 125,000 | 125,000 |

Annual RSUs | – | 125,000 | 125,000 |

| (1) | Retainer amounts are paid in cash in quarterly installments. |

| (2) | Each new non-management director receives an initial RSU grant and an annual RSU grant thereafter on the date of our Annual Meeting of Shareholders. The initial grant is prorated to reflect service between the election date and the one-year anniversary of the prior year’s Annual Meeting of Shareholders. We value the RSUs based on the closing share price on the grant date. RSUs vest one year from the grant date (or, for annual grants, on the date of the next Annual Meeting of Shareholders, if earlier) and settle in common shares. We accrue cash dividend equivalents that are payable upon vesting of the RSUs. All unvested RSUs become fully vested upon a “change of control” (as defined under “Potential Payments on Termination of Employment and Change of Control” on page 47) unless the director is asked to continue to serve on the board of directors of the surviving entity or its affiliates and receives a qualifying replacement award. |

Directors may receive additional compensation for performing duties assigned by the Board or its committees that are considered beyond the scope of the ordinary responsibilities of directors or committee members. Messrs. Darden and Kenny and Ms. Cox receive $10,000 per year for service on the Ad Hoc Committee and Mr. Downey receives $25,000 per year for chairing the Ad Hoc Committee.

Directors may elect to defer payment of their cash retainers into the Cardinal Health Deferred Compensation Plan (“DCP”). For directors, deferred balances under the DCP are paid in cash upon termination from Board service, death or disability in a single lump sum or annual installment payments over a period of five or ten years. A director also may defer receipt of common shares that otherwise would be issued on the date that RSUs vest until termination from Board service.

Our directors may participate in our matching gift program. Under this program and subject to certain restrictions, the Cardinal Health Foundation (our philanthropic affiliate) will match contributions for eligible non-profit organizations.

Cardinal Health |2019 Proxy Statement25

Director Compensation for Fiscal 2019

The non-management directors received the following compensation during fiscal 2019:

Name | Fees Earned or Paid in Cash ($) |

| Stock Awards ($) | (1) | All Other Compensation ($) |

| Total ($) |

David J. Anderson(2) | 18,207 |

| – |

| – |

| 18,207 |

Colleen F. Arnold | 103,247 |

| 175,001 |

| – |

| 278,248 |

Carrie S. Cox | 126,236 |

| 175,001 |

| – |

| 301,237 |

Calvin Darden | 113,247 |

| 175,001 |

| – |

| 288,248 |

Bruce L. Downey | 128,247 |

| 175,001 |

| – |

| 303,248 |

Patricia A. Hemingway Hall | 112,989 |

| 175,001 |

| – |

| 287,990 |

Akhil Johri | 103,247 |

| 294,581 | (3) | – |

| 397,828 |

Clayton M. Jones(4) | 42,065 |

| – |

| – |

| 42,065 |

Gregory B. Kenny | 204,946 |

| 300,001 |

| – |

| 504,947 |

Nancy Killefer | 103,247 |

| 175,001 |

| – |

| 278,248 |

David P. King(4) | 40,313 |

| – |

| – |

| 40,313 |

J. Michael Losh(5) | 74,538 |

| 161,443 | (6) | 3,000 | (7) | 238,982 |

Dean A. Scarborough(8) | – |

| – |

| – |

| – |

John H. Weiland(8) | – |

| – |

| – |

| – |

(1) These awards are RSUs granted under the Amended Cardinal Health, Inc. 2011 Long-Term Incentive Plan (the “2011 LTIP”). We valued the RSUs by multiplying the closing price of our common shares on the NYSE on the grant date by the number of RSUs awarded. As of June 30, 2019, the aggregate number of shares underlying unvested RSUs held by each director serving on that date was as follows: Ms. Arnold — 3,164 shares; Ms. Cox — 3,164 shares; Mr. Darden — 3,164 shares; Mr. Downey — 3,164 shares; Ms. Hemingway Hall — 3,164 shares; Mr. Johri — 5,326 shares; Mr. Kenny — 5,424 shares; Ms. Killefer — 3,164 shares; and Mr. Losh — 3,225 shares. (2) Mr. Anderson resigned from the Board in September 2018. (3) Reflects Mr. Johri’s annual grant made in November 2018 and a make-up initial RSU grant made in November 2018. (4) Mr. Jones and Mr. King decided not to stand for re-election at the 2018 Annual Meeting of Shareholders. (5) Mr. Losh joined the Board in December 2018. (6) Reflects initial RSU grant made in December 2018. (7) Represents a company match attributable to a charitable contribution under our matching gift program. (8) Messrs. Scarborough and Weiland joined the Board in September 2019, after the end of fiscal 2019. | |||||||

Related Person Transactions Policy and Process

Related Person Transactions Policy

We have a written policy that the Audit Committee must approve or ratify any “related person transactions” (transactions exceeding $120,000 in which we are a participant and any related person has a direct or indirect material interest). “Related persons” include our directors, nominees for election as a director, persons controlling over 5% of our common shares, executive officers and the immediate family members of each of these individuals.

Once a related person transaction is identified, the Audit Committee will review all the relevant facts and circumstances and determine whether to approve the transaction. The Audit Committee will take into account such factors as it considers appropriate, including the material terms of the transaction, the nature of the related person’s interest in the transaction, the significance of the transaction to the related person and us, the nature of the related person’s relationship with us and whether the transaction would be likely to impair the judgment of a director or executive officer to act in our best interest.

If advance approval of a transaction is not feasible, the Audit Committee will consider the transaction for ratification at its next regularly scheduled meeting. The Audit Committee Chairman may pre-approve or ratify any related person transactions in which the aggregate amount is expected to be less than $1 million.

Since July 1, 2018, there have been no transactions, and there are no currently proposed transactions, involving an amount exceeding $120,000 in which we were or are to be a participant and in which any related person had or will have a direct or indirect material interest.

| www.cardinalhealth.com | Cardinal Health | 2019 Proxy Statement 26 |

Ratification of Appointment of Ernst & Young LLP as Independent Auditor

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent auditor and approves the audit engagement with Ernst & Young LLP and its audit fees. The Audit Committee has appointed Ernst & Young LLP as our independent auditor for fiscal 2020 and believes that the continued retention of Ernst & Young LLP as our independent auditor is in the best interest of Cardinal Health and its shareholders. Ernst & Young LLP has served as our independent auditor since 2002. In accordance with SEC rules, lead audit partners are subject to rotation requirements, which limit the number of consecutive years an individual partner may serve us. The Audit Committee oversees the rotation of the audit partners. The Audit Committee Chairman interviews candidates for audit partner and the Audit Committee discusses them.

While not required by law, we are asking our shareholders to ratify the appointment of Ernst & Young LLP as our independent auditor for fiscal 2020 at the Annual Meeting as a matter of good corporate governance. If shareholders do not ratify this appointment, the Audit Committee will consider whether it is appropriate to appoint another audit firm. Even if the appointment is ratified, the Audit Committee in its discretion may appoint a different audit firm at any time during the fiscal year if it determines that such a change would be in the best interest of Cardinal Health and its shareholders. Our Audit Committee approved, and our shareholders ratified with 98.6% support, the appointment of Ernst & Young LLP as our independent auditor for fiscal 2019.

We expect representatives of Ernst & Young LLP to be present at the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and to respond to appropriate questions from shareholders.

| The Board recommends that you vote FOR the proposal to ratify the appointment of Ernst & Young LLP as our independent auditor for fiscal 2020. |

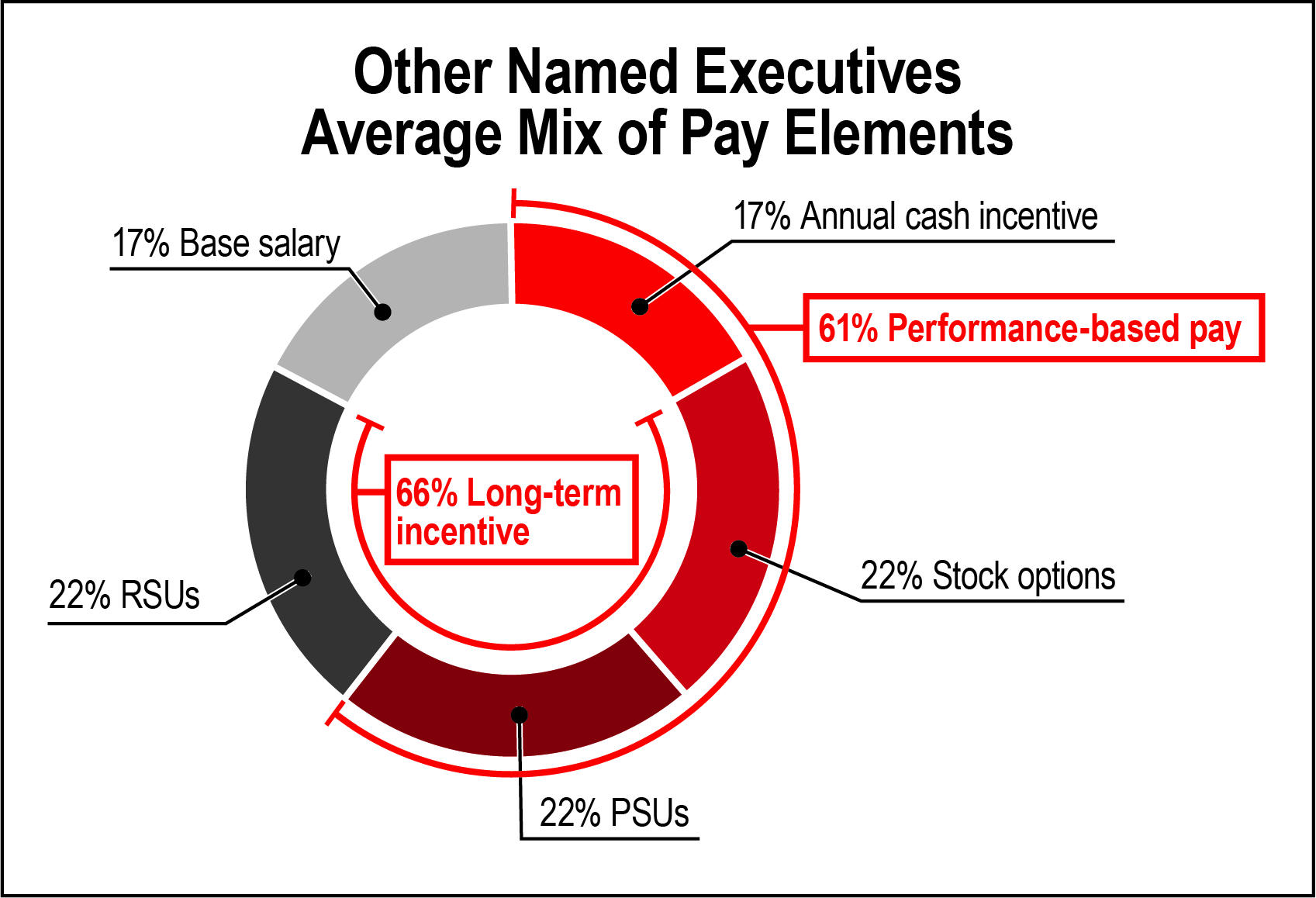

The Audit Committee is responsible for overseeing: the integrity of Cardinal Health’s financialstatements; the independent auditor’s qualifications, independence and performance; Cardinal Health’s internal audit function; Cardinal Health’s ethics and compliance program and its compliance with legal and regulatory requirements; and Cardinal Health’s processes for assessing and managing risk. As of the date of this report, the Audit Committee consists of four members of the Board of Directors. The Board of Directors has determined that each of Messrs. Downey, Losh and Johri is an “audit committee financial expert” for purposes of the SEC rules and that each Committee member is independent. The Audit Committee’s activities are governed by a written charter, which is available on Cardinal Health’s website at www.cardinalhealth.com under “About Us — Corporate — Investor Relations — Corporate Governance — Board Committees and Charters.”